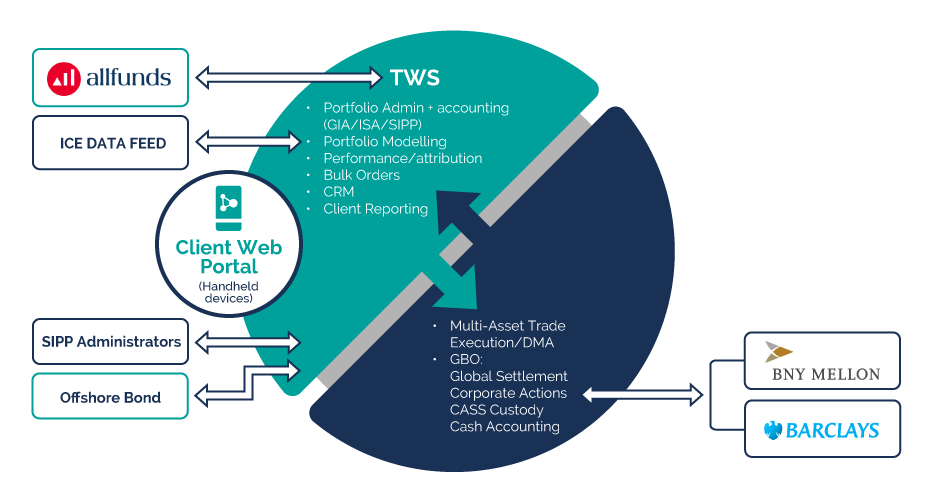

Integrated Dealing, Custody and Administration

Our Wealth Solution platform offers a compelling alternative to traditional administration models through its core deliverables of scalability, efficiency and innovation.

As a full end-to-end investment lifecycle services platform, we are fully compliant with CASS 6 and 7 with client assets and cash held with BNY Mellon and Barclays Bank.

Central Investment Proposition

Developed and managed by Titan Asset Management, the CIP is built on four investment pillars

Model portfolios and fund-of-funds (comprising ETFs and third-party mutual funds)

Active and passive investment management

ESG

Direct equities

Clients can choose between managed funds, MPS and direct equities

- Based on end client investment risk profiles

- Different performance outlook and tax treatment (funds trade exempt of CGT)

- MPS are lower cost, more passively managed

Titan Group Capabilities

Built into the platform, the wider Titan Group bring additional user benefits including

- Global solutions and multiple asset classes support

- Execution, settlement and associated custody in over 20 markets

- Underpinned by BNYM

- Cash accounts in over 15 currencies all held under CASS.

- Margin enhancement

- Best practice investment management

- Competitive commercial framework

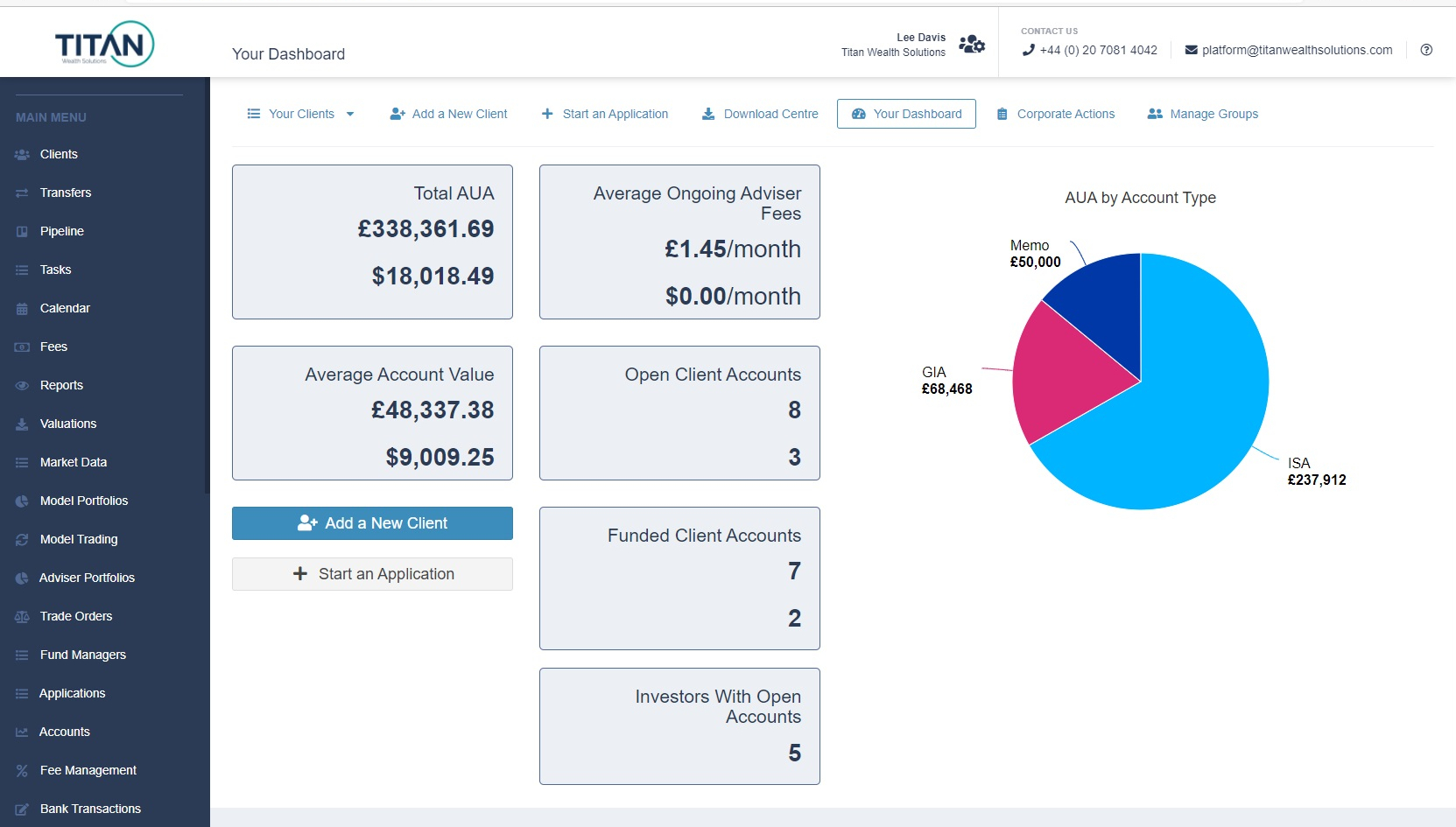

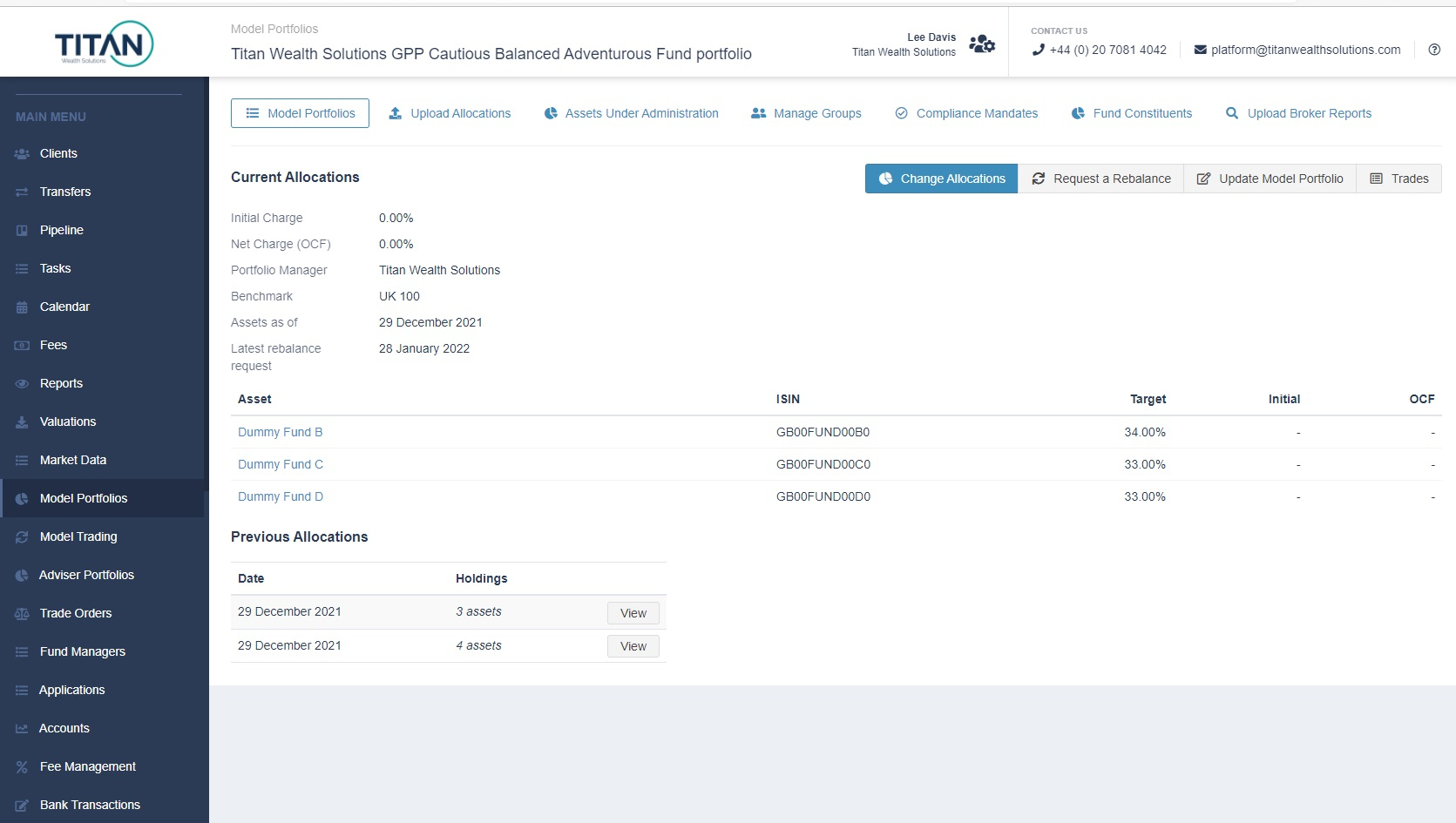

Next Generation Platform

An integrated platform for the full investment lifecycle providing our clients with a comprehensive yet agile, white-labelled solution which can be easily modified for a bespoke service.

By designing and building a new platform we have been able to incorporate the key functionality demanded by DFMs. The platform provides seamless and intuitive modelling/rebalancing, flexible fee calculations, compliance and risk management services enabling DFMs to operate efficiently and effectively.

In addition to the functionality, additional benefits include seamless scalability, cost and operational efficiency and ongoing innovation through the intelligent use of technology.

Proprietary Technology

- Investments API connectivity to leading financial planning platforms ( Intelliflo and X Plan)

- Automated adviser and client workflows including:

- Automated adviser and client workflows including:

Trading

Payments

Fee collection

Extensive Client Functionality

Fully white-labelled

Choice of indices & benchmarks

GIPS-compliant performance calculations

HMRC-compliant CGT reporting

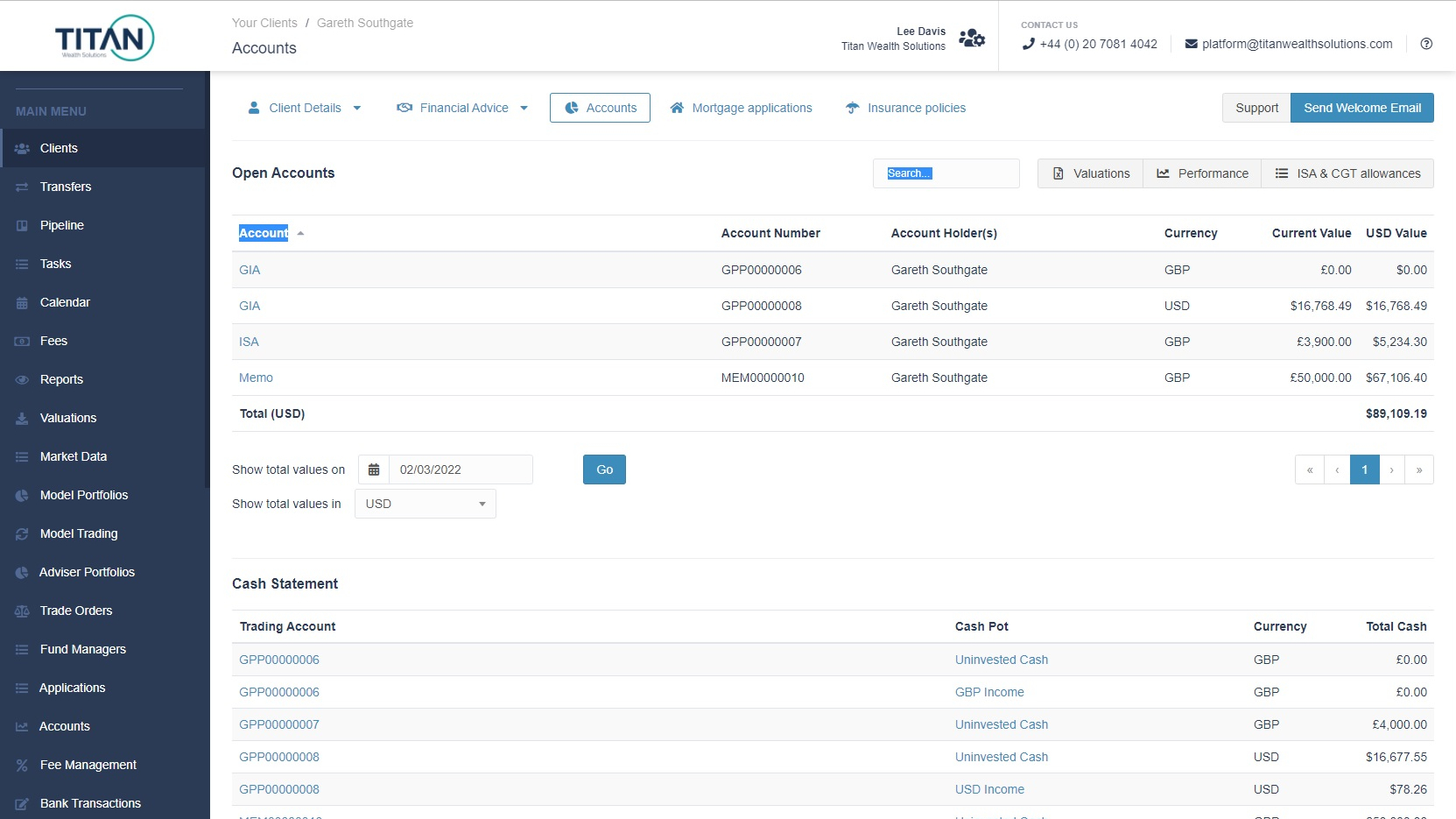

Diverse Asset Product Range

The platform offers the functionality to deliver a diverse asset product range including:

- GIA

- S&S ISA, Junior ISA, Flexible ISA

- Trust, Corporate, Charity

- 3rd party SIPP, SASS, QROPS, QNUPS and offshore bonds

Proprietary Technology

- Investments API connectivity to leading financial planning platforms (Intelliflo and X Plan)

- Automated adviser and client workflows including:

- Trading

- Payments

- Fee Collection

Access

- A diverse asset product range through the platform:

- GIA

- Stocks and Shares ISA, Junior ISA, Flexible ISA

- Trust, Corporate, Charity

- SASS and Offshore Bonds

- SIPP (via Morgan Lloyd)

Extensive Client Functionality

- Fully white-labelled

- Choice of indices and benchmarks

- GIPS-compliant performance calculations

- HMRC-compliant CGT reporting